Disclaimer: This is not financial advice. Anything stated in this article is for informational purposes only and should not be relied upon as a basis for investment decisions. Triton may maintain positions in any of the assets or projects discussed on this website.

TL;DR

Crypto Compendium – Part XIV – What Comes Next?

We’ve covered quite a bit of ground over the past few months with this series, and for those that have followed along with each post, we thank you for your continued attention. What began as a theoretical exploration of Satoshi Nakamoto’s Bitcoin whitepaper evolved into a fairly panoramic survey of a very real revolution taking place in financial technologies. Over these now-fourteen segments, we’ve tried to elucidate blockchain’s transformation from a theoretical way to minimize frictions in online payments to an incredibly dynamic marketplace of programmable value, privacy advances, innovation and real on-chain, investable cash flows.

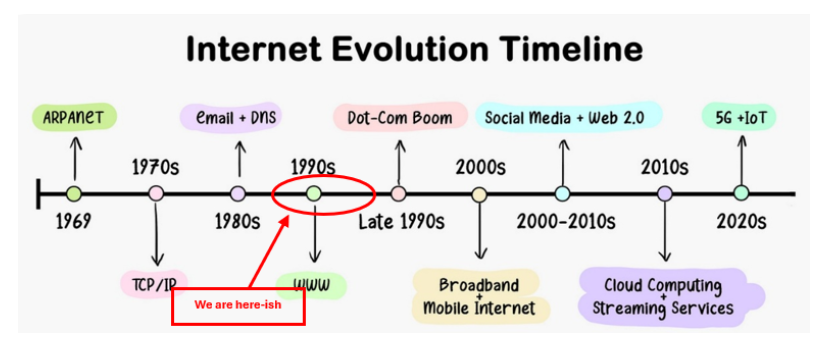

In our earliest chapters, we explained the very practical reasons for crypto’s invention in the context of the status quo of finance: slow settlement, opaque bookkeeping, and a complete overreliance on third party intermediaries despite living in an internet-first age. Enter Bitcoin in 2008, a novel experiment in cryptography and game theory that not only asked us to trust math over messengers, but finally gave us the technology to do so at internet scale. Importantly, rather than some immaculate conception out of nowhere, we stressed that Bitcoin is the result of many years of failed attempts at creating internet-native value systems, following the same path of any technological development. It just happened to be the first to truly succeed.

We explained why the intentional design of Bitcoin - 21 million coins, programmatic reductions in inflation, open-source code and incredible game theory – positions it as a neutral non-sovereign asset that can act as a store of value in times of financial strife; that is, act as digital gold. And that genesis served to set the tone for what we covered later: Bitcoin was never really about fringe ideology, but about offering individuals around the world an alternative to the financial status quo that has never before existed. As we see growing concern over the US debt situation, warning signals arising in global capital markets (i.e. Japan), broadening international trade conflicts, and a race by sovereign banks to acquire more gold, more investors around the world are starting to view Bitcoin as one of the best escape hatches from our current financial constructs. The fact that Bitcoin continues to reach new all-time highs against this backdrop speaks volumes.

We then turned our view towards the advancements that have followed Bitcoin’s invention, with deep dives into smart contracts, applied cryptography and rival layer-1 networks. Ethereum, with its Turing-complete compute environment, provided us with the novel ability of decentralized on-chain programmable value, even if the network remains relatively slow and frequently priced out users in its earliest days. But those frictions opened the door for Solana, Base, Arbitrum, Optimism and other high-performance networks to compete, and despite their incredible advancements, we have stressed that we are still in the early stages of development for this industry. There are still fundamental issues that need to be solved before crypto is truly ready for primetime, but every day there continues to be advancements that move the technology forward in tremendous ways.

The relative dearth of practical applications and user-friendly experiences is still a major pain point to be addressed. But we are right on the cusp of this technology exploding into mainstream adoption. Individuals all over the world that have long been the lifeblood of crypto are now being joined by companies, pension funds and even sovereign governments in owning Bitcoin and using blockchain technology to improve financial systems. Regulatory clarity continues to increase with an undeniable arc towards a further embrace of crypto, including the imminent passing of two landmark bills in the US covering stablecoins and crypto market structure. These are likely the two largest remaining hurdles to clear before traditional financial institutions are able and willing to embrace crypto fully. And we are right at that tipping point now.

We devoted an entire segment to stablecoins because it is increasingly clear that they represent one of the most game-changing advancements in financial technology in decades. Without drama or fanfare – and truthfully in the face of active opposition that still exists today - stablecoins have grown to a $250 billion dollar technology that is already transforming payments, lending, and liquidity provision and are actively being adopted by payment giants such as Visa, Mastercard, Stripe and Paypal. Some of the biggest banks in the world (JPMorgan Chase, Bank of America, Citigroup and Wells Fargo) recently announced an intention to jointly launched a stablecoin project; they just need the green light from regulators. A fully programmable digital dollar that is available 24/7, self-custodied, permissionless and globally transmissible with near-instant finality and essentially free to transact? That is real utility, full stop. And as the likes of USDC and USDT continue to pipe trillions in volumes natively across the internet, they quietly underscore blockchain’s most practical promise: programmable settlement rails that operate around the clock and around the world.

We also looked ahead to quantum computers as one of the most oft-cited threats to blockchain technology. In truth, they do present a tangible threat to ECDSA encryption and thus one of the most core components of blockchain security. But thankfully, the conversation around post-quantum cryptography and network hard forks is already well underway with many ecosystems already taking steps to get in front of any threats. The technological piece will be relatively easy to solve; it is the social piece that remains the bigger wild card. And here, one needs to trust that the ecosystems and communities that have gotten crypto to where it is today will protect and evolve the networks to be resistant against future threats. It is up for each investor to decide if the theoretical risk of unproven technology outweighs the proven capabilities of the global crypto community that literally now have trillions at stake to protect.

At the heart of what makes programmable value truly unique lies composability and interoperability: the magic of money legos. We illustrated how novel mechanisms like yield-stripping, perpetual swaps, and synthetic collateral can be pieced together into complex strategies that to this point were available only to the most well-connected financial actors but are now accessible to anyone with an internet connection at the click of a mouse. This is where the chaos of crypto and DeFi transcends niche curiosities and circular games and becomes a financial engineer’s dream, enabling anyone to develop financial primitives that were previously the exclusive domain of legacy institutions and deep-pocketed investors. Since the invention of the internet, software has fundamentally changed how we interact with the world purely based on how we move information. Imagine what we can do now that we can extend that functionality to value itself.

Finally, we grounded our series in tangible, real cash flows to answer the question: what is the intrinsic value of any of this? Specifically, we demonstrated how tokens now absolutely represent direct exposure to investable crypto-native businesses. We provided examples of just four protocols that collectively drive hundreds of millions of quarterly cash flows to token holders, with no equity operating companies in sight. It is still very true that there are a high number of scams and absurdly overvalued tokens on the market, but these are increasingly pushed to the fringes and recognized for what they are. This will only continue as more and more professional capital enters the market through liquid funds like Triton.

So, as we close out this Compendium series, we leave the reader with three observations to consider going forward:

Makes one wonder.

Part XV is yet to be written

This series has been both an intellectual overview and a practical deep dive. Yet, if there is one takeaway from these fourteen segments, it’s that blockchain’s story is far from finished. Each new protocol, each governance proposal, and each breakthrough in cryptography adds another chapter to this dynamic and volatile odyssey.

In closing, we hope this series has served to help the reader better understand where we have come from, where we are today, and most importantly, provide the context to start imagining where this technology will take us in the future. From trustless consensus through atomic composability to mature, cash-flowing projects and ecosystems, the arc towards adoption and value creation is undeniable. But the final chapters remain unwritten. And if the last decade of crypto has taught us anything, it’s that innovation in the space is less about predicting the future and more about building it, one block at a time.

Crypto is not a single asset class but a stack of distinct economic verticals, each with its own risk drivers and valuation logic. Triton applies a vertical-first, KPI-specific framework, similar to equity sector analysis, to avoid metric misuse and generate more durable alpha in liquid markets.

Crypto is moving beyond the four-year cycle as institutional adoption, easing macro conditions, and structural market changes redefine how returns are formed.

TritonLLM brings together Triton’s research library, on-chain data, and AI workflow to accelerate analysis, surface opportunities, and build a more adaptive, resilient investment process in today’s evolving crypto market.